Page 56 of 98

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 06, 2020 2:39 pm

by LordMortis

To follow up on my TSLA sell, I am pulling the plug on the pittance of shares I have of ROKU and DIS that I bought in the deep valley. This recent rally in the US just seems like a drug induced euphoria and there's got to be a hangover coming when earnings start rolling in (or not). I was thinking about killing my few shares of LOW, UNP, and JNJ that I also picked up on the cheap but I figure those are dividend stocks and even if they come back down they're still paying me more'n CDs or a savings account. I'll be keeping my few shares of MSFT and AAPL for the long haul, I think. I don't think opportunities come around like they did in April , like ever.

I don't understand any of it but I'll take the money and run and only wish I had more to play with in April when I was spending like a drunken sailor, that and I wish I hadn't jumped at selling my few shares of SPOT the day before it took off. I shouldn't have bought any in the first place if I was going to be that impatient with it.

(Also AMZN, I get, even I can't warrant buying. WFH is going drive up more and more cloud servers and online retail)

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 7:41 am

by LordMortis

Can/Should I do anything specific if TD Ameritrade over pays a dividend by a factor of 10. I picked up 10 shares of SPAB last month to test the waters of investing in a long term indexed Bond fund over CDs. I expected my first monthly dividend of $.62 today. Instead I received a monthly dividend of $6.23. Do I report that? And how? Can I assume they will figure it our and just take back ~$5.50. (I still hate ~ means around. My logic classes from 20+ years ago still scream ~ means not)

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 9:29 am

by noxiousdog

LordMortis wrote: Tue Jul 07, 2020 7:41 am

Can/Should I do anything specific if TD Ameritrade over pays a dividend by a factor of 10. I picked up 10 shares of SPAB last month to test the waters of investing in a long term indexed Bond fund over CDs. I expected my first monthly dividend of $.62 today. Instead I received a monthly dividend of $6.23. Do I report that? And how? Can I assume they will figure it our and just take back ~$5.50. (I still hate ~ means around. My logic classes from 20+ years ago still scream ~ means not)

They'll figure it out, but if you still see it in 90 days, follow up. They may just take the hit themselves.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 9:34 am

by LawBeefaroni

If it's wrong, they'll figure it out. Just don't spend the ca.$5.50. (how's that for an ambiguous prefix?)

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 9:43 am

by pr0ner

LawBeefaroni wrote: Tue Jul 07, 2020 9:34 am

If it's wrong, they'll figure it out. Just don't spend the ca.$5.50. (how's that for an ambiguous prefix?)

I mean, LM is in Michigan. That's Canadia, right?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 9:50 am

by LordMortis

pr0ner wrote: Tue Jul 07, 2020 9:43 am

LawBeefaroni wrote: Tue Jul 07, 2020 9:34 am

If it's wrong, they'll figure it out. Just don't spend the ca.$5.50. (how's that for an ambiguous prefix?)

I mean, LM is in Michigan. That's Canadia, right?

$5.50 CAD. I also note that when we used to sit at the table and play penny poker before Texas Hold'em chips were all anyone ever did, if any Canadian change made it on the table Remus West would take it from the pot and throw it across the room.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 9:56 am

by pr0ner

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 10:05 am

by LordMortis

While I am here, I will mention for posterity, in hopes that I learn from my mistakes, I took all my ill gotten gains from yesterday that I managed to keep liquid for all of 24 hours, saw GSK has been taking a big dip this morning, and in spite of BREXIT, I increased my position to 100 shares so I could set a covered call.

(I think I will also need to eventually sell off some of my longterm drags that have been sitting in my portfolio as learning lessons for years to counter the gains from selling this year. I'm totally not sure when I should start that process or how to go about it)

Edit:

And speaking of lessons learned and reminders. If you go back far enough in this thread, I bought some SNAP when it went IPO because it was all the rage at the time and promised to become a platform like competitive social media. It proceeded to tank and lay in the gutter. Years later, it's yet to make a buck and its fan appreciation and youth support is long gone but in the last month it's been taking off, probably on the tailwinds of TikTok, I'm guessing. If it actually gets the price I paid, I will get to unload it with my only loss being opportunity cost of a few dollars over the years. I'm tempted to let it go now... but greed and gambling.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 2:09 pm

by LordMortis

While I'm spending too much energy not doing work. Does anyone have an opinion on TROW? I ask because they are one of the big backers of RIVIAN and I do have faith RIVIAN are coming to market in a good way (with another of their big backers being Amazon and yet another being Ford).

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 07, 2020 2:20 pm

by LawBeefaroni

Lightened up on Overstock. Hard to believe it was under $3 in March. Hit $45 today. Have to sell some of that.

They also had a dividend they issued via blockchain. It was intriguing so I picked up some more on their tZero platform. $8 then, hit $30 today.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 08, 2020 7:09 am

by LordMortis

That took one day. I'm glad. I don't want to have to watch their math on everything all of the time. I'm way too small time for that.

07/07/2020 16:41:53 ORDINARY DIVIDEND (SPAB) -6.23

07/07/2020 17:15:47 ORDINARY DIVIDEND (SPAB) 0.62

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 08, 2020 6:49 pm

by LawBeefaroni

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 09, 2020 11:36 am

by LordMortis

It's too irresponsible of me to throw in more money but if it weren't this is when I'd start again but not in the indexes. They're still too high from the tech stocks jump, I suspect. CVS around 60 looks good to me. F back under $6 has been good for me to buy and sell options on. I was also looking for a good entry point for GE to then turn around and sell option on and this could have been it. At this pace, they're all likely to fall lower, so I'd have wanted enough to start buying now and buy more as they decline but again, only it would be irresponsible of me to "find" cash to buy this current ride down. I guess I should have sold even more than I did on Monday and built a small pile of cash to hold and play with. If this drop keeps pace through Friday and things really look like a bargain, it's going to be hard to resist the gambling gene.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 09, 2020 11:30 pm

by xwraith

I have a couple of short options positions on, all for 8/21 at the moment:

AMD $50 Put (Cash Covered)

AMD $57.50 Covered Call

XLE $33 Put (Cash Covered)

My AMD position is basically a strangle but I don't care if the stock gets called away as it's a covered call -- it just means I lose some upside if the stock goes over $60.

My XLE put is getting tested a bit, looking at the stock it's been in a down trend for a month and XLE lost another 5% today alone. I've got time so I just may let it ride. If I get assigned I'll just sell a covered call or I could roll it out and down a strike tomorrow and get a small credit too.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Jul 10, 2020 4:03 pm

by Zaxxon

TSLA: Hold my beer.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Jul 10, 2020 4:13 pm

by coopasonic

Zaxxon wrote: Fri Jul 10, 2020 4:03 pm

TSLA: Hold my beer.

I'm glad I never bought in because I would have sold at like $600 and be so pissed right now.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Fri Jul 10, 2020 4:18 pm

by Zaxxon

coopasonic wrote: Fri Jul 10, 2020 4:13 pm

Zaxxon wrote: Fri Jul 10, 2020 4:03 pm

TSLA: Hold my beer.

I'm glad I never bought in because I would have sold at like $600 and be so pissed right now.

I've done that (and regret it somewhat, although it has helped me be more stoic about the remaining position since the initial investment is no longer on the line).

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 13, 2020 9:21 am

by noxiousdog

The pain is coming:

32% of US households missed their July housing payments.

Zaxxon, how you respond to the Tesla critics that say that deliveries have been essentially flat for 6 quarters now and that all profits are not due to selling cars, but to selling EV credits?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 13, 2020 9:29 am

by Zaxxon

noxiousdog wrote: Mon Jul 13, 2020 9:21 am

Zaxxon, how you respond to the Tesla critics that say that deliveries have been essentially flat for 6 quarters now and that all profits are not due to selling cars, but to selling EV credits?

On the first part, we'll have to see how Q3 and Q4 go, since Tesla is still claiming 500k for the year which means significant jumps later this year. It's also a certainty that had more than half their factory capacity not been shuttered for much of the quarter amid a pandemic, Q2 would have been significantly higher volume. And looking out further from this year, the Shanghai factory is about to finish doubling in size and Berlin is being built. One of Texas/Tulsa will likely break ground yet this year. Quarter-by-quarter views of the company aside, it's quite clear that they are poised to continue major expansion over the next few years.

On the 2nd, I think most companies would love to have their expansion largely financed by their competitors. EV credit sales aren't going anywhere anytime soon, and Tesla is poised to continue benefiting from them for the foreseeable future.

But don't mistake me as one defending the current

checks notes $1660/share valuation as a sober reading of the current environment. I am prepping to sell a significant portion of my holdings. This is just too insane given the precarious macro environment of 2020.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 13, 2020 10:21 am

by pr0ner

One story I read about Tesla seemed to indicate that Tesla will be unable to manufacture/sell cars in China for any kind of profit whatsoever.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 13, 2020 10:26 am

by coopasonic

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 13, 2020 10:27 am

by Zaxxon

Even for Tesla, that's got to be at least a dozen cars or so.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Mon Jul 13, 2020 11:56 am

by noxiousdog

This is nuts.

I can't believe the market keeps going higher. This is like 2008 when "nobody saw the crash coming" even though it just took a cursory glance to see it was coming.

Earnings season is going to be a disaster. I re-balanced my 401k to go 85% cash.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 14, 2020 1:54 pm

by LordMortis

LordMortis wrote: Tue Jul 07, 2020 2:09 pm

While I'm spending too much energy not doing work. Does anyone have an opinion on TROW? I ask because they are one of the big backers of RIVIAN and I do have faith RIVIAN are coming to market in a good way (with another of their big backers being Amazon and yet another being Ford).

Heh

Rivian Raises $2.5 Billion As Investors Chase Electric Car Buzz

10:33 am ET July 10, 2020 (Dow Jones) Print

By Ben Foldy

Rivian Automotive LLC, an electric pickup-truck startup backed in part by Ford Motor Co. and Amazon.com Inc., said Friday it had secured another $2.5 billion in funding from private investors, providing it with extra cash to help navigate growing economic uncertainty and release new vehicles next year.

Asset-management firm T. Rowe Price Group, Inc. led the investment round, which in addition to raising more money from existing investors also attracted new backers, including the Soros Fund Management LLC and Fidelity Investments, Rivian said Friday in a press release.

Amazon and BlackRock Inc. also added to their earlier investments, the company said.

The new funding round illustrates that the auto industry's push to electric vehicles is still generating interest from investors, even as the economic fallout of the Covid-19 pandemic has dented buyer demand for vehicles and forced many auto makers to draw down on their credit lines to shore up cash.

Rivian plans to launch three new models in 2021, including commercial delivery vans for Amazon's fleet and a fully-electric pickup.

"Our teams are working hard to ensure our vehicles, supply chain and production systems are ready for a robust production ramp up," founder and Chief Executive R.J. Scaringe said in a statement.

Rivian, founded more than a decade ago in suburban Detroit, has captured the interest of both auto and tech executives in recent years with its plans for the pickup and SUV market, squarely taking aim at Detroit's dominance in two highly-profitable categories.

The company's first two models, the R1T electric pickup and R1S SUV, were expected later this year but have been delayed due to pandemic-related supply-chain disruptions. The vehicles are now expected to go on sale early next year, each priced around $70,000 before electric-vehicle tax credits.

Rivian has targeted outdoor enthusiasts in its marketing, depicting the company's futuristic vehicles against rugged landscapes rather than urban backdrops. The company plans to sell directly to consumers instead of relying on the traditional dealership model.

Investment in electric-car technology remains strong, as both startups and traditional auto makers vie to become the next Tesla Inc. Tesla's share price has increased nearly 25% in just over a week, and the company's valuation at over $250 billion roughly equals that of Ford, Toyota Motor Corp., General Motors Co. and Fiat Chrysler Automobiles NV combined.

Auto companies have been eager to combine the investor exuberance for electric cars with the profit potential of popular large SUVs and pickup trucks, and are investing billions into what's still a novel technology for many buyers.

While its closest competitors have benefited from enthusiasm in the public markets around electric vehicles, Rivian has drawn most of its investment through private financing.

Today's raise adds to the more than $2.8 billion it raised last year from investors including Ford and cable-conglomerate Cox Enterprises Inc., which also has dozens of auto-related businesses.

In 2017, Rivian acquired a former Mitsubishi plant in Normal, Ill., to build its vehicles.

Last year, Rivian moved into the commercial-delivery market, where the limited range of electric vehicles and slower refueling times are less of a concern for buyers. The company has a deal with Amazon to design and provide 100,000 electric delivery vans in the next decade as part of the e-retail behemoth's plans to eliminate its carbon footprint before 2040.

Write to Ben Foldy at

Ben.Foldy@wsj.com

(END) Dow Jones Newswires

July 10, 2020 10:33 ET (14:33 GMT)

noxiousdog wrote: Mon Jul 13, 2020 9:21 am

Zaxxon, how you respond to the Tesla critics that say that deliveries have been essentially flat for 6 quarters now and that all profits are not due to selling cars, but to selling EV credits?

That was literally what set the price point for my buying Telsa.

noxiousdog wrote: Mon Jul 13, 2020 11:56 am

This is nuts.

I can't believe the market keeps going higher. This is like 2008 when "nobody saw the crash coming" even though it just took a cursory glance to see it was coming.

Earnings season is going to be a disaster. I re-balanced my 401k to go 85% cash.

You're smarter than I'll ever be. I'm fighting myself to not go all irresponsible and cash in more and more on options trading. I've taken and grown my positions too much already, so I could sell covered calls, picking up 5% every other week or so on the money I put in. I'm still cashing in, but this week I'm also watching short positions growing.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 14, 2020 2:21 pm

by Zaxxon

Nice to see Rivian getting what they need. I still have high hopes for them despite their delays.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 14, 2020 2:32 pm

by LordMortis

Zaxxon wrote: Tue Jul 14, 2020 2:21 pm

Nice to see Rivian getting what they need. I still have high hopes for them despite their delays.

I didn't even pollute your Tesla thread to talk about them.

From where I sit they are doing so much right it's unreal. Can they get market share? Dunno. Amazon is a good way to muscle in though. If they got it going on, they have the shared drivers of a fleet of potentially 30,000 vehicles to provide word of mouth. They are just doing so much right, it's hard to deny them a seat at the table. They are both listening to experts and rejecting paradigm to do it their way. They are the Arya Stark of automobiles.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 14, 2020 2:36 pm

by Zaxxon

LordMortis wrote: Tue Jul 14, 2020 2:32 pm

Zaxxon wrote: Tue Jul 14, 2020 2:21 pm

Nice to see Rivian getting what they need. I still have high hopes for them despite their delays.

I didn't even pollute your Tesla thread to talk about them.

From where I sit they are doing so much right it's unreal. Can they get market share? Dunno. Amazon is a good way to muscle in though. If they got it going on, they have the shared drivers of a fleet of potentially 30,000 vehicles to provide word of mouth. They are just doing so much right, it's hard to deny them a seat at the table. They are both listening to experts and rejecting paradigm to do it their way. They are the Arya Stark of automobiles.

I haven't gotten to actually drive one (as virtually no one has), but I did get up close and personal with both the R1S and R1T in February and they're both looking really good to me.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Tue Jul 14, 2020 2:40 pm

by LordMortis

Zaxxon wrote: Tue Jul 14, 2020 2:36 pm

I haven't gotten to actually drive one (as virtually no one has), but I did get up close and personal with both the R1S and R1T in February and they're both looking really good to me.

I work in the same township as their now primary engineering facility turned HQ and I still haven't been next to one personally. (Also TROW up 123 to 129 since that bit of press in a generally up market. I wanted to buy on a hunch but no money and no knowledge where I have too much in an overvalued market already of has kept me out.)

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 8:37 am

by LordMortis

LordMortis wrote: Tue Jul 14, 2020 1:54 pm

You're smarter than I'll ever be. I'm fighting myself to not go all irresponsible and cash in more and more on options trading. I've taken and grown my positions too much already, so I could sell covered calls, picking up 5% every other week or so on the money I put in. I'm still cashing in, but this week I'm also watching short positions growing.

If this Euphoria holds through Friday some of my covered calls will be striked... stricken... struck... And I'd be hard pressed to find stuff I'm comfortable enough buy back to make more covered calls. It's been some pretty big rise in the last two days. I had been making a few bucks off resetting a $7 covered call for GE, $4.5 for NOK, and two units of F for $6.5 that look like they could pay off on Friday at this point. Then a whole lot more if the Euphoria continues until next Friday. Nearly all of my covered calls are ITM (in the money) and I thought they were all set to make me little money but keep them to reset. Shows what I know. So I'll be a bit more cash and in the black on my sales for the year if the pace continues. I don't get how it could continue, though.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 10:15 am

by LawBeefaroni

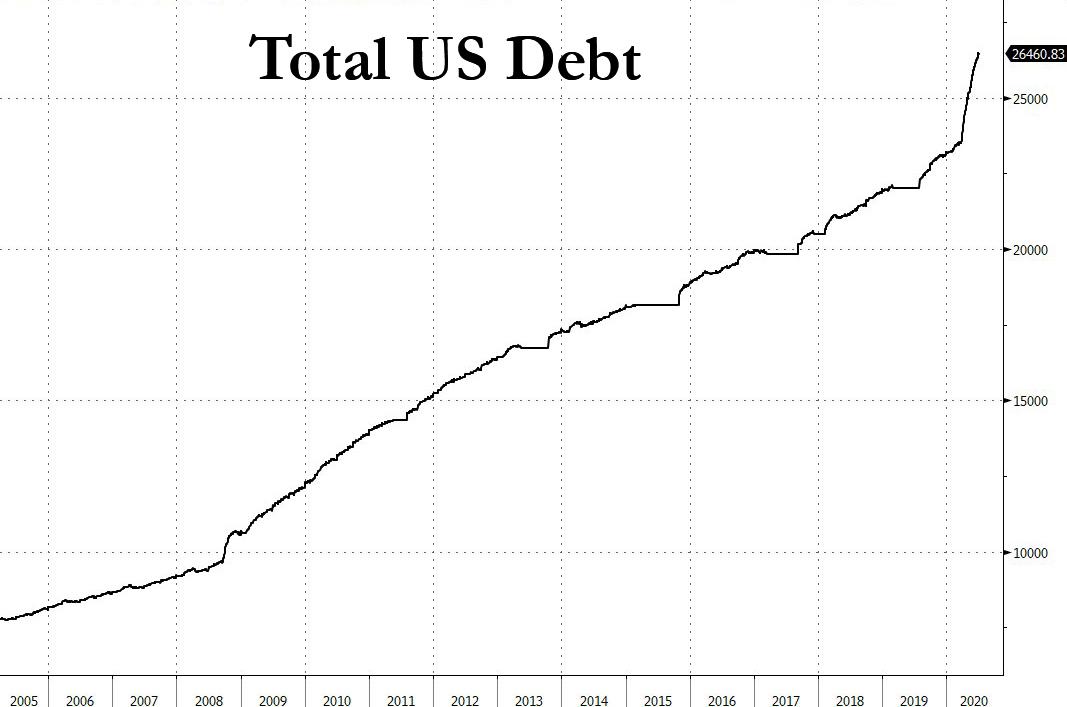

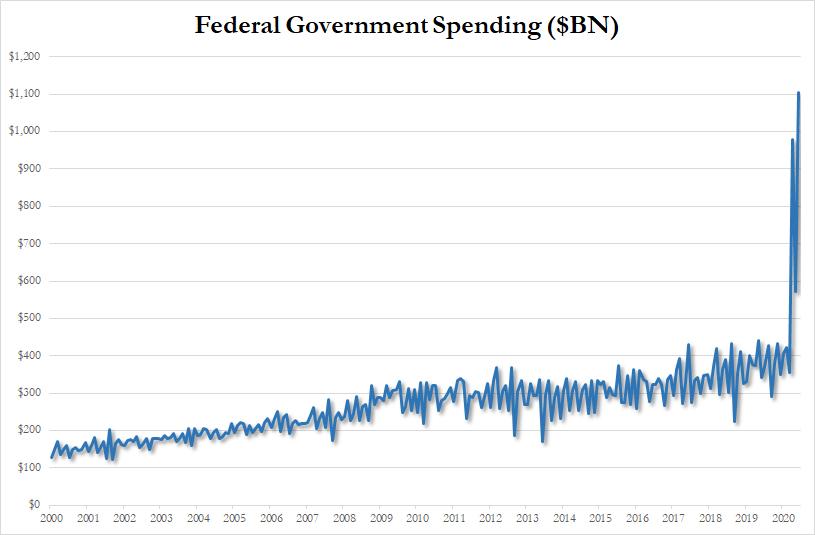

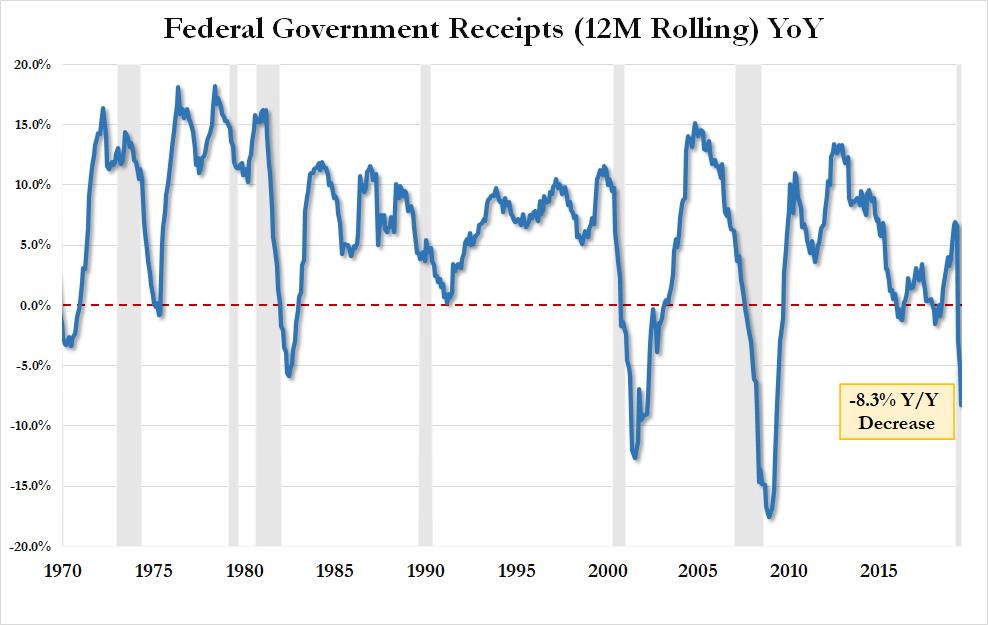

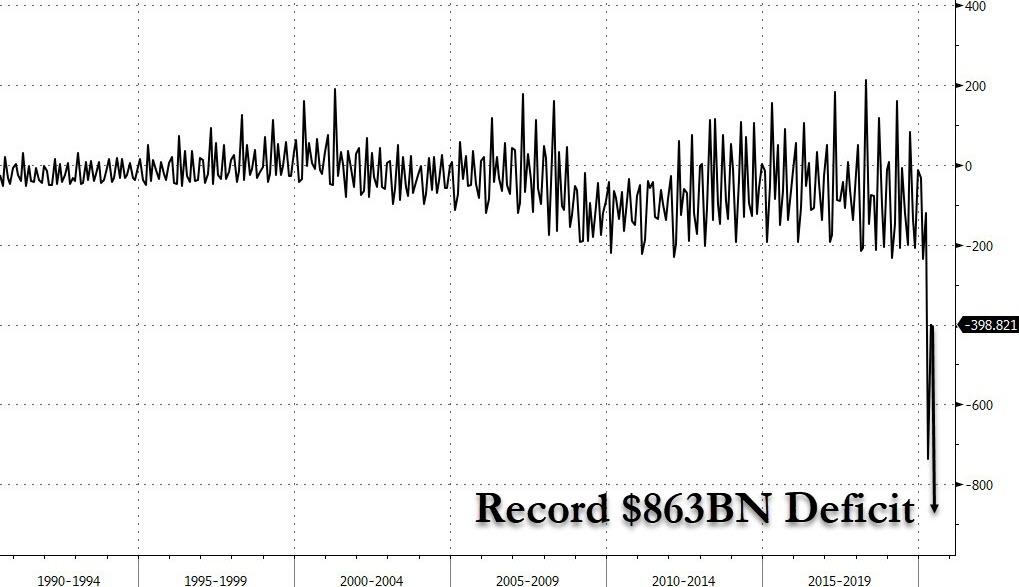

It can continue as long as it can be propped up by federal debt.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 10:19 am

by LordMortis

That's not a game I can play. I always lose at roulette and lord knows if someone else can control when the ball will fall?

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 12:48 pm

by Pyperkub

LawBeefaroni wrote: Wed Jul 15, 2020 10:15 am

It can continue as long as it can be propped up by federal debt.

Yeah, the junk bond buying spree is doing wonders. Socializing corporate debt/losses does wonders for the stock markets.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 1:27 pm

by LordMortis

One by one I'm watching all of my covered calls convert ITM (in the money) TD Ameritrade then insults me by telling me how much money I'm not making by having putting out covered calls at lower rates than what they are going for now. They're good problems to have. If I could bank on this volatile stagnation, I'd quit my job tomorrow.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 1:49 pm

by Zaxxon

LordMortis wrote: Wed Jul 15, 2020 1:27 pm

One by one I'm watching all of my covered calls convert ITM (in the money) TD Ameritrade then insults me by telling me how much money I'm not making by having putting out covered calls at lower rates than what they are going for now. They're good problems to have. If I could bank on this volatile stagnation, I'd quit my job tomorrow.

Hey, you wants the guaranteed payout, you takes the associated risk of lost gains. I say this as someone with a covered call expiring next week that I grant 50/50 probability of finishing ITM.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Wed Jul 15, 2020 2:05 pm

by LordMortis

Zaxxon wrote: Wed Jul 15, 2020 1:49 pm

Hey, you wants the guaranteed payout, you takes the associated risk of lost gains. I say this as someone with a covered call expiring next week that I grant 50/50 probability of finishing ITM.

I know. But I'm gambler and pessimist enough to already "I shoulda" on my trades and having the UI taunt me with it is just cruel. I

should be ecstatic to get my call price, get my target selling price that I thought was more than a stock is worth, and get out while the market is just being stupid. I'm not wired that way. Someone fix me.

Example, I've been making $40 every other week on a KR covered call for $34. When/if it goes, short term shares I paid $31.50 on average (I think) will put $250 in my pocket and return my $3000 to me when signs say reduce your equities holdings. There is no downside (unless the market shits itself and I get in such a bad way that I have to sell while it's trying clean itself up) but my brain will still see right now that my $.49 call is currently getting $.79.

And in a psychotic way, it make the whole thing fun to talk about... which by the by kinda sorta almost related, I was reading about gambling and endorphin release recently. The bit I was reading claims that losing at gambling releases nearly as much endorphins as does winning.

....Looks up going rate $2000 OTM (Out of the Money) call for Tesla for next week.... 30.75... Crazy.... 1,809 of them have traded at assorted rates.... Crazy....

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 16, 2020 9:15 am

by LordMortis

These stories of me are becoming more and more common and describe what confirms my bias and therefore must be true

https://www.vox.com/business-and-financ ... -robinhood

She is not an anomaly. In recent months, the stock market has seen a boom in retail trading. Online brokerages have reported a record number of new accounts and a big uptick in trading activity. People are bored at home, sports betting and casinos are largely off the table, and many look at that $1,200 stimulus check they got earlier this year as free money. Some are taking cues from mainstream sources like the Wall Street Journal and CNBC, others are looking at Reddit and Barstool Sports’ Dave Portnoy for ideas (and entertainment). And commission-free trading on gamified apps makes investing easy and appealing, even addicting.

raditionally, stock-trading has come with a fee, meaning if you wanted to buy or sell, you had to pay for each transaction. But companies like Robinhood have taken a jackhammer to that system by offering commission-free trading. Other major online brokers — Charles Schwab, E-Trade, and TD Ameritrade — have followed suit.

I'm hoping the big difference between my and the mass of "retail uptick" is 1) I don't margin trade. 2) my option trading is strictly not so active covered calls 3) I fight my instinct to put in the kind of money that would drive me to ruin if the market to a 30% shit. 4) I recognize that my option trading is gambling with a mitigated risk (having reason to believe none of the companies I invest in will go bankrupt)

The bit says a lot specifically about Robinhood. I'm pretty thrown back on how much it sounds like a casino with initial freeplay, and lights on your trades to draw you in.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 16, 2020 10:02 am

by LawBeefaroni

The Robinhood crowd is a bunch of YOLO gamblers. It's ridiculous. Royal Norwegian just smoked them, btw.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 16, 2020 10:20 am

by malchior

LawBeefaroni wrote: Thu Jul 16, 2020 10:02 am

The Robinhood crowd is a bunch of YOLO gamblers. It's ridiculous. Royal Norwegian just smoked them, btw.

I can't also help but wonder how many outright criminals are lurking in there.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 16, 2020 11:23 am

by noxiousdog

This surprises me not at all.

Re: Overlords Investment Conclave [OIC] Recruitment Thread

Posted: Thu Jul 16, 2020 12:23 pm

by noxiousdog